Safeguarding Your Business with Financial Lines Insurance

Financial lines insurance provides vital protection for businesses and professionals against a range of financial risks, including allegations of mismanagement, negligence, or breaches of duty. The most common policies include such as Management liability, Professional Indemnity, and Cyber Liability, it helps safeguard both individuals and organisations from costly legal claims, regulatory investigations, and reputational damage.

In an increasingly litigious and regulated environment, this type of insurance is essential for ensuring financial stability and peace of mind. The policies provide coverage for legal defence costs, settlements, and other related expenses, allowing business leaders and professionals to focus on their operations with confidence, knowing they are protected from unforeseen liabilities.

Case Study: Cyber Protection

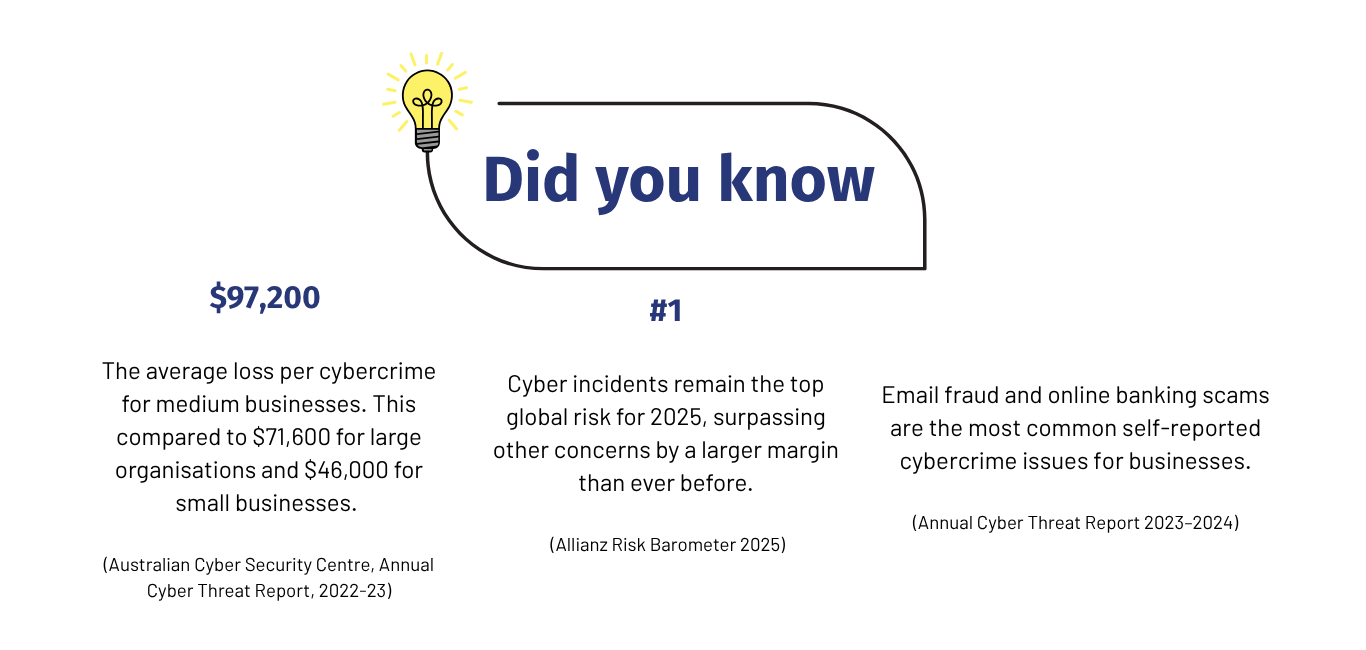

Your employee opens an email attachment infected with a ransomware virus.

Access to your systems and data are blocked and the virus software informs you

that it will remain unavailable unless you pay the ransom amount. Rather than

paying the hacker and opening your business up to further extortion attempts,

you hire external IT consultants to recover your back-up data and files and

upgrade your antivirus software.

Over the week it takes to apply these fixes, you have to close your business,

causing you to lose revenue. It also affects your reputation with your clients; one

of your clients threatens to sue you for the delay which cost them a large

amount of money.

A Cyber Protection Insurance policy allows you to recover some of the costs you

incur during this incident. Depending on your policy, you may be able to make a

claim for losses caused by the interruption to your business, the costs of

recovering your data and upgrading your software, and ongoing crisis

management expenses

Case Study:

Site Calculation Error

Michael is an engineer who designs the supporting foundations of a

residential property. He makes an error with the site calculations – which

leads to the slab cracking and damage to the property of the owner. His

company is liable for this loss, which could be anywhere between $150,000

up to the full value of the house.

But because Michael has professional indemnity insurance, he’s covered for

this amount – as well as any legal expenses if the matter goes to court.

Case Study:

Wrongful Dismissal

A former employee claims they were wrongfully dismissed from your

business because they were unwell at the time their position was

terminated. They want to be reinstated to their role and remunerated for

their loss of income while they were out of work. After numerous

unsuccessful conciliation attempts, the matter is brought before a court

and you have to pay damages to your former employee.

A Management Liability policy allows you to recover some or all of these

costs so you can continue to run your business without having to sell your

business or personal assets. Depending on your policy, you may be able to

make a claim for your legal defence costs, as well as the amount paid to

your former employee.